What is Community Infrastructure Levy (CIL)?

Community Infrastructure Levy (CIL) is a charge that can be levied by Local Authorities on new development in their area. Local Authorities use CIL to help them fund the infrastructure needed to support development, such as schools, transport, flood defences, hospitals, community facilities and other health and social care facilities.

Most new development which creates net additional floor space of 100 square metres or more, or creates a new dwelling, is potentially liable for the levy. It is a common misconception that CIL doesn't apply to domestic extensions of above 100m2; it does.

Each Local Authority sets their own charging schedule. The Levy only applies in Local Authorities who have properly consulted upon, and adopted, a charging schedule following an Examination in Public. This is typically part of a new Local Plan process. The schedule sets out its Levy rates and is published on the Local Planning Authority website. The charges are based on the size and type of the new development.

The Local Authority can set different rates for different geographical zones in their administrative area and for different uses of development. There is no requirement for a local authority to charge the CIL if it does not want to – or it can be set at a zero rate. This is often the case for strategic schemes which require significant infrastructure costs (roads, schools, sewage plants etc) or for areas which the Local Planning Authority wish to see regeneration come forward, such as run-down manufacturing sites close to a town centre or for parts of a town centre in need of redevelopment for wider town planning reasons.

Do I have to pay a CIL charge?

Development will be liable to pay CIL if:

Upon payment, providing you are not subject to any relief or clawback periods, the Local Authority remove the CIL charge from the Land Charges Register. If relief is granted, the CIL remains on the Land Charges register for 3-7 years depending on whether exemption or relief has been granted. In the event of a disqualification occurring, such as you're selling the 'Self-Build' home within 3 years, the CIL charge will be removed when the time period lapses.

Enforcement on CIL

There are strong Enforcement powers and penalties for failure to pay CIL. These penalties include stop notices, surcharges, late payment interest and sometimes even prison terms (yes, you did read that correctly!).

Please not - CIL liability is held as a charge on site. If CIL is not paid you may have difficulty selling your land/property.

Who is exempt from paying CIL?

Development will be exempt from CIL in the following circumstances and only once the correct exchange of paperwork has been confirmed with the Local Planning Authority (do not proceed until you have this confirmation):

How is CIL calculated?

CIL is levied per square metre and is calculated by multiplying the Local Authority CIL Charging Rate (as set by the Local Authority) by the net Chargeable Floor Space (based on Gross Internal Area) and factoring in an index figure to allow for annual indexation between the year in which planning permission was granted and the year in which the Local Authority CIL Charging Schedule took effect, using the RICS CIL indices.

The Levy Charging Schedule is set out by the Charging Authority (see Section 211(1) of the Planning Act 2004). Charging Assistants consider National Planning Policy Framework when drafting their Charging Schedule.

The Chargeable Floor Space is the Gross Internal Area (floorspace) of the proposed development less the floorspace of any existing ‘in-use’ buildings to be demolished.

Community Infrastructure Levy (CIL) is a charge that can be levied by Local Authorities on new development in their area. Local Authorities use CIL to help them fund the infrastructure needed to support development, such as schools, transport, flood defences, hospitals, community facilities and other health and social care facilities.

Most new development which creates net additional floor space of 100 square metres or more, or creates a new dwelling, is potentially liable for the levy. It is a common misconception that CIL doesn't apply to domestic extensions of above 100m2; it does.

Each Local Authority sets their own charging schedule. The Levy only applies in Local Authorities who have properly consulted upon, and adopted, a charging schedule following an Examination in Public. This is typically part of a new Local Plan process. The schedule sets out its Levy rates and is published on the Local Planning Authority website. The charges are based on the size and type of the new development.

The Local Authority can set different rates for different geographical zones in their administrative area and for different uses of development. There is no requirement for a local authority to charge the CIL if it does not want to – or it can be set at a zero rate. This is often the case for strategic schemes which require significant infrastructure costs (roads, schools, sewage plants etc) or for areas which the Local Planning Authority wish to see regeneration come forward, such as run-down manufacturing sites close to a town centre or for parts of a town centre in need of redevelopment for wider town planning reasons.

Do I have to pay a CIL charge?

Development will be liable to pay CIL if:

- It is a building which people go into to use and the gross internal area (GIA) of new build will be more than 100m2 (this includes extensions to existing buildings including residential dwellings).

- One or more new dwellings is created - even where the new build floorspace is less than 100m2.

Upon payment, providing you are not subject to any relief or clawback periods, the Local Authority remove the CIL charge from the Land Charges Register. If relief is granted, the CIL remains on the Land Charges register for 3-7 years depending on whether exemption or relief has been granted. In the event of a disqualification occurring, such as you're selling the 'Self-Build' home within 3 years, the CIL charge will be removed when the time period lapses.

Enforcement on CIL

There are strong Enforcement powers and penalties for failure to pay CIL. These penalties include stop notices, surcharges, late payment interest and sometimes even prison terms (yes, you did read that correctly!).

Please not - CIL liability is held as a charge on site. If CIL is not paid you may have difficulty selling your land/property.

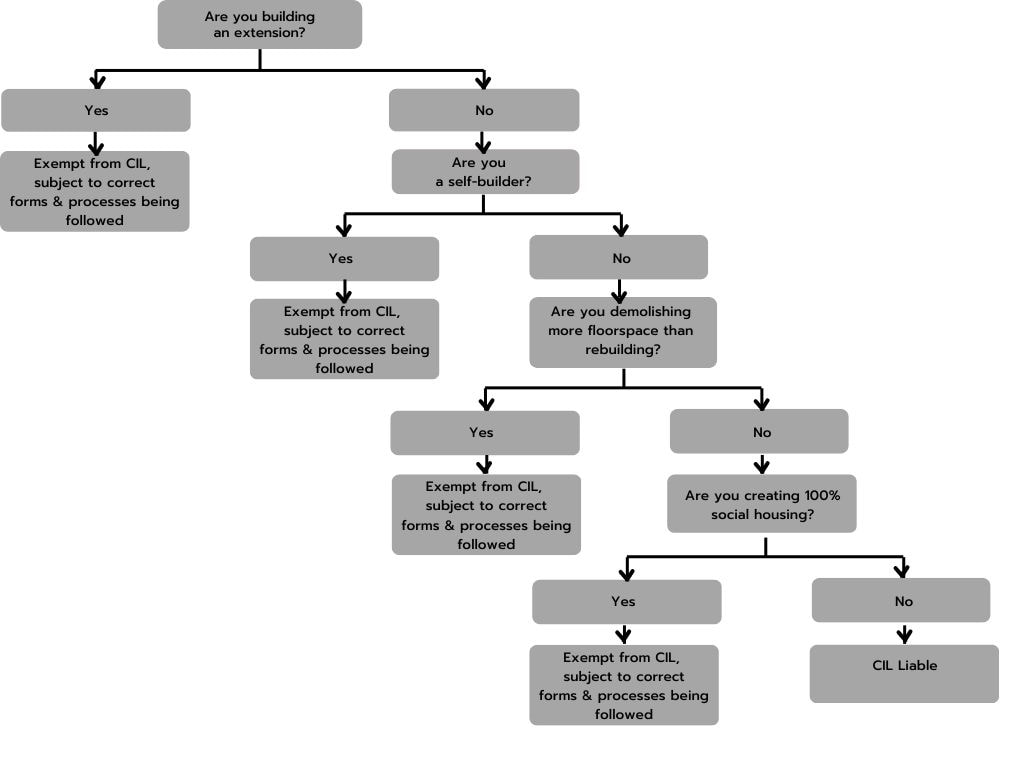

Who is exempt from paying CIL?

Development will be exempt from CIL in the following circumstances and only once the correct exchange of paperwork has been confirmed with the Local Planning Authority (do not proceed until you have this confirmation):

- The proposals are affordable housing, charitable development or built by 'Self Builders'.

- The scheme is a change of use or replacement building with no additional floorspace (mezzanines are CIL liable).

- The development is a structure to which people do not usually enter (i.e. wind turbines or service area under a swimming pool).

How is CIL calculated?

CIL is levied per square metre and is calculated by multiplying the Local Authority CIL Charging Rate (as set by the Local Authority) by the net Chargeable Floor Space (based on Gross Internal Area) and factoring in an index figure to allow for annual indexation between the year in which planning permission was granted and the year in which the Local Authority CIL Charging Schedule took effect, using the RICS CIL indices.

The Levy Charging Schedule is set out by the Charging Authority (see Section 211(1) of the Planning Act 2004). Charging Assistants consider National Planning Policy Framework when drafting their Charging Schedule.

The Chargeable Floor Space is the Gross Internal Area (floorspace) of the proposed development less the floorspace of any existing ‘in-use’ buildings to be demolished.

|

CIL Levy =

|

LPA CIL Charge Rate* x Chargeable Floor Space x RICS CIL Index for the year PP is granted**

RICS CIL Index for the year the LPA Charging Schedule was adopted**

|

*The Local Authority CIL Charge Rate will be published on the LPA website

**The RICS website states the CIL indices since 2020, you will need to approach the LPA to obtain any RICS CIL indices for previous years

*Note that each Council may differ in what is included and excluded in CIL liable floorspace and therefore it is advisable to check with them prior to planning any works. Alternatively, seek professional assistance and make sure that your contract with your planning consultant includes completion of the right forms correctly at the right point in time.

**The RICS website states the CIL indices since 2020, you will need to approach the LPA to obtain any RICS CIL indices for previous years

*Note that each Council may differ in what is included and excluded in CIL liable floorspace and therefore it is advisable to check with them prior to planning any works. Alternatively, seek professional assistance and make sure that your contract with your planning consultant includes completion of the right forms correctly at the right point in time.

When is CIL payment due?

CIL will be payable within 60 days of development commencing, or if the Local Planning Authority have an instalment policy it will be paid in accordance with that policy.

However:

- Where no one has assumed liability, but a commencement notice has been received, payment is due immediately upon commencement.

- Where the Council have determined a 'deemed commencement' date (because no valid Commencement Notice was provided), payment is due on the deemed commencement date.

- There are also special provisions under Regulation 71 where the Council have to transfer liability to the land owners or where charitable or social housing relief has been granted and a 'disqualifying event' has taken place. (These will be under very unusual circumstances).

What is Gross Internal Area (GIA)?

GIA is , in simplified terms, the whole enclosed area of a building within the external walls, taking each floor into account and excluding the thickness of the external walls...more about GIA

What is chargeable floor space?

For more information on Chargeable Floor Space and Gross Internal Area Click Here

What is the CIL process?

The CIL process aligns with the planning process and the initial CIL Form 1 is submitted at the same time as the Planning Application. A summary of the forms and when to submit them can be found below, along with a link to the latest forms on the Planning Portal.

How important is CIL?

It is important to be aware of the CIL requirements and it is advised that no work should commence on the development site until written confirmation is received from the Local Planning Authority, either confirming the development is exempt or with a Liability Notice. For an example of how serious it is to ignore these provisions, see some relevant Case Law.

When does CIL become liable?

In most cases a Commencement Notice, CIL Form 6, must be served prior to the commencement of development. If you commence work prior to submitting CIL Form 6 the following could occur:

- any exemption or relief may be revoked;

- the full CIL charge may become payable;

- and a surcharge may be applied.

Who pays the levy?

The responsibility to pay CIL sits with the ownership of the land on which the liable development is located. However, others parties involved in the development, such as developers, may wish to pay a proportion of the CIL.

When should I submit a CIL form?

The table below lists a summary of the various CIL forms, when they need to be completed and a link to the forms on the Planning Portal

The table below lists a summary of the various CIL forms, when they need to be completed and a link to the forms on the Planning Portal

CIL FORM |

DESCRIPTION |

DOWNLOAD |

Form 1: CIL Additional Information |

All planning applications must be accompanied by Form 1 which asks for basic information about the project;

|

|

Form 2: Assumption of Liability |

If the development is CIL liable, submit Form 2 at the same time as Form 1, for ease of process. Note: If you think the application is exempt from CIL then submit the appropriate exemption or relief form (see below). Note: Once planning permission has been granted, a Liability Notice outlining an estimate of the amount is issued to all relevant parties if CIL is due. |

|

Form 3: Withdrawal of Assumption of Liability |

If you sell the site or plot, you can withdraw or transfer the liability at any time before the development commences using Form 3 or 4 (whichever is applicable). |

|

Form 4: Transfer of Assumed Liability |

If you sell the site or plot, you can withdraw or transfer the liability at any time before the development commences using Form 3 or 4 (whichever is applicable). |

|

Form 5: Notice of Chargeable Development |

This form is used to give notice of work which may be liable for CIL being carried out under General Consent / Permitted Development Rights. This notice should be submitted to the council before work commences. |

|

Form 6: Commencement Notice |

Before work commences on site (including demolition) use Form 6 to notify the Council of the date of commencement. Note: Once a Commencement Notice is received, a Demand Notice will be issued. This notice will detail who is liable for the CIL, for how much, any reliefs or surcharges payable, and will also specify the payment dates. |

|

Form 7: Self Build Exemption Claim Pt 1 |

This form is used to make a claim for self build exemption when a new dwelling is being constructed. This should be only used when the dwelling is going to be your primary residence on completion for at least three years. |

|

Form 7: Self Build Exemption Claim Pt 2 |

This form must be submitted within six months of completion, accompanied by the supporting evidence set out in the form. Set quarterly diary reminders well in advance. |

|

Form 8: Residential Annex Exemption Claim |

This form should be used to claim for self build exemption when the work being carried out is the creation of a residential annex, to be used as ancillary accommodation to the main dwelling. |

|

Form 9: Residential Extension Exemption Claim |

This form should be used to claim for exemption when there is a domestic extension area of 100 square metres or more. |

The forms are from PlanningPortal.co.uk (updated in April 2022) MDP accept no responsibility for inaccurate or out of date information on this page, which is provided in good faith to assist and clarify.